The process revolution for banks

Client onboarding and client retention in a 100% digital customer journey!

Transform your onboarding and retention processes into digital customer experiences

With the ajila Platforms for banks, we help to efficiently and digitally handle all business processes from KYC (Know Your Customer), lead generation via mortgage calculator to the conclusion of all customer contracts with online forms, contract generation and electronic signatures with one solution approach. Up to several thousand PDF documents and contracts become a digital experience thanks to our platforms and know-how based on over 20 years of experience.

We guarantee:

More customers

Through continuous conversion optimization

Higher customer satisfaction

Through unique user experience

Cost reduction

Thanks to digital process automation

Resource Saving

Thanks to form full service

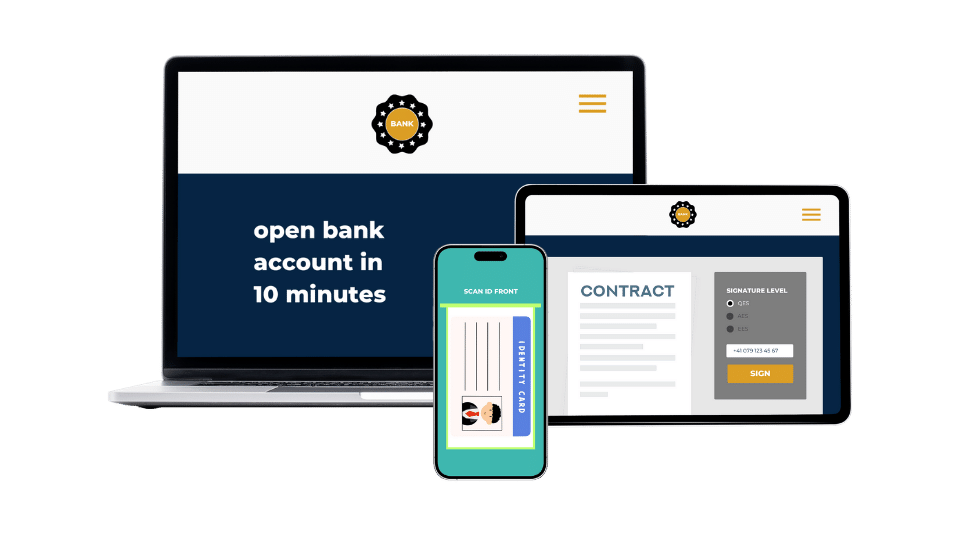

Use Case: Client Onboarding

Client Onboarding enables companies to handle their new client process completely online at the highest legal level using qualified electronic signatures (QES).

All included!

- Consulting

- Implementation

- ajila Cloud Platforms

- Operation & Maintenance

Roger Wüthrich-Hasenböhler

CDO | Swisscom (Schweiz) AG

"Our subsidiary Ajila has implemented a digitized account opening process at a cantonal bank that allows customers to open an account without human intervention. Online identification takes place via smartphone, is legally recognized and absolutely secure. This is an innovation. The advantage is now becoming apparent with the bank merger. In March, there were six times as many online account openings as in the first two months."

This is why banks trust us

- Confidentiality

Ajila always treats customer data confidentially and is compliant with CH-DSG and EU-GDPR - Data processing

Form data is only stored temporarily and is irrevocably deleted after successful transaction - Location

Form data is only processed at an ISO 27001 cloud provider in Switzerland - Encryption

The form data is always encrypted during transmission and at rest - Access

Very restricted access policy by vetted employees of ajila AG or Swisscom. Accesses only allowed from Switzerland - Consistent identification

Data collection & identification is carried out in accordance with the Money Laundering Act (GwG), zertES & eiDAS

More conversions thanks to digitization

We would be happy to show you how we not only digitize processes for banks, but revolutionize them.

- Increase your conversion rate by providing your customers with simple and automated onboarding and retention processes that are available 24/7.

- Identify your customers at the highest level according to the Money Laundering Act (GwG), zertES & eiDAS and cover all FINMA and BaFIN requirements

- Automatically authorize your customers to sign at the highest level with our identification process: the Qualified Electronic Signature.

Strong partners

Benefit from our excellent relationships with our renowned partners from day one.